8 Easy Facts About $255 Payday Loans Online Same Day Shown

Wiki Article

Not known Incorrect Statements About $255 Payday Loans Online Same Day

Table of ContentsExcitement About $255 Payday Loans Online Same Day5 Easy Facts About $255 Payday Loans Online Same Day DescribedUnknown Facts About $255 Payday Loans Online Same DayA Biased View of $255 Payday Loans Online Same DayWhat Does $255 Payday Loans Online Same Day Do?

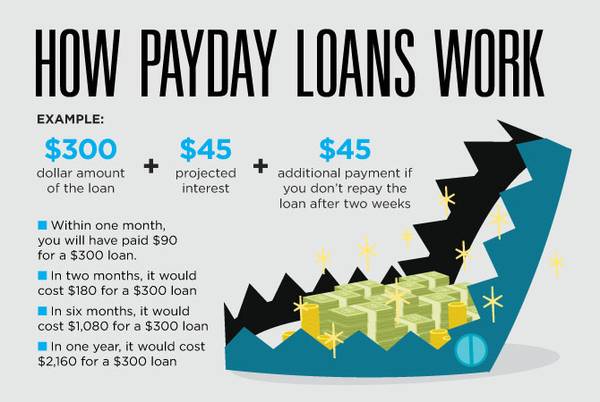

If you're considering a payday advance, then you might intend to look first at much safer personal funding alternatives. Cash advance car loan carriers will usually need you to show proof of your incomeusually your pay stubs from your employer. They will certainly then provide you a section of the cash that you will be paid.Cash advance lenders tackle a great deal of danger, because they don't inspect your ability to repay the loan. Due to the fact that of this, they typically bill really high rate of interest for cash advance, as well as they may additionally bill high charges if you miss your settlements. This can be harmful for borrowers since it can mean that you'll need to borrow more cash to cover the price of the first loan.

, you should generally give pay stubs from your company that show your present degree of revenue. Numerous also use a borrower's earnings as security.

The 45-Second Trick For $255 Payday Loans Online Same Day

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

In the United States, since 2022, 16 states and the Area of Columbia have actually outlawed payday advance. Investopedia/ Michela Buttignol Payday lending institutions charge very high levels of rate of interest: as high as 780% in annual percentage rate (APR), with an average car loan going for virtually 400%. Many states have usury laws that limit rate of interest costs to anywhere from 5% to 30%.

As these fundings get approved for lots of state lending technicalities, consumers should be skeptical. Rules on these car loans are controlled by the private states, with 16 states, Arizona, Arkansas, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Dakota, Vermont, and West Virginiaand the District of Columbia outlawing payday advance of any type of kind.

Finance costs on these finances likewise are a considerable element to think about, as the average cost is $15 per $100 of financing. Many financings are for 30 days or less and aid debtors to meet short-term liabilities.

The Facts About $255 Payday Loans Online Same Day Revealed

The regulations additionally needed loan providers to supply written notification prior to attempting to gather from a borrower's savings account and additional called for that after 2 not successful attempts to debit an account, the lender might not try once more without the consent of the consumer. These regulations were first proposed in 2016 and under the Biden Administration, the new leadership at the CFPB established more stringent guidelines for payday financing, which came to be necessary on June 13, 2022.Kraningerissued proposed guidelines to withdraw the required underwriting provision as well as hold-up application of the 2017 guidelines. $255 Payday loans online same day. In June 2019, the CFPB released a final policy delaying the August 2019 compliance date, and on July 7, 2020, it released a final policy revoking the compulsory underwriting stipulation yet leaving in area the restriction of repeated attempts by payday loan providers to accumulate from a borrower's checking account.

Lots of cash advance lending institutions do not even reveal their costs as a rate of interest price, see it here but they instead charge a fixed flat cost that can be anywhere from $10 to $30 per $100 borrowed. Most payday car loans are unsafe.

$255 Payday Loans Online Same Day for Dummies

The visit here loan provider may ask you to write a check for the payment amount, which the lending institution will certainly cash when the financing is due. Under government regulation, lenders can not condition a payday car loan on acquiring an authorization from the consumer for "preauthorized" (repeating) electronic fund transfers.Yet the cash advance may be submitted once it is passed to the collection agencies after the lending institution sells the financial obligations. If you repay your payday advance on schedule, after that your credit history rating should not be influenced. On the various other hand, if you skip on your financing and also your financial debt is positioned in the hands of a debt collection agency, after that you will certainly see a dip in your rating.

This is due to the fact that cash advance loan providers make substantial sums from the passion that they bill on these loans. This indicates that you ought to try and also repay payday financings as quickly as you possibly can. If you can't pay back a cash advance, the account might be sent to a collection agency, which will certainly seek you for the cash and also interest that you owe.

The Only Guide to $255 Payday Loans Online Same Day

Payday lenders may ask for a financial institution account, yet often a pre-paid card account may be sufficient to certify. Since these car loans cost so much as well as may be tough to settle, it's practically description constantly best to avoid them.

Due to this, you ought to only get a payday loan if you are definitely certain that you can pay it back. Cash advance are developed to cover temporary expenses, as well as they can be obtained without collateral and even a checking account. The catch is that these loans bill very high fees and also rates of interest.

Report this wiki page